27+ Louisiana Property Tax Calculator

Web Result Your Details. Press calculate to see the.

Https Www Google Com Search About This Image Img H4siaaaaaaaa Wewaon Chqi66qy8977okbfei 5k52815boqcaf Xewaaaa Q Https Bpw Maryland Gov Meetingdocsarchives 04 1975 2520april 252016 2520minutes Pdf Ctx Iv

Marginal tax rate 22 Effective tax rate 1094 Federal income tax.

. To calculate your property tax you will need to know the assessed property value and the mill levy on your property. Our Louisiana Property Tax Calculator can estimate your property taxes based on similar properties and show you. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal.

The calculator is clever its. Web Result Jan 22 2024 Updated Jan 23 2024. You can check with your local assessors office to find the specific tax rate for your property.

Calculator to provide information on how property taxes will change between 2023 and 2024 in New Orleans. The median property tax in Lafayette Parish Louisiana is 583 per year for a home. Compare your rate to the Louisiana and US.

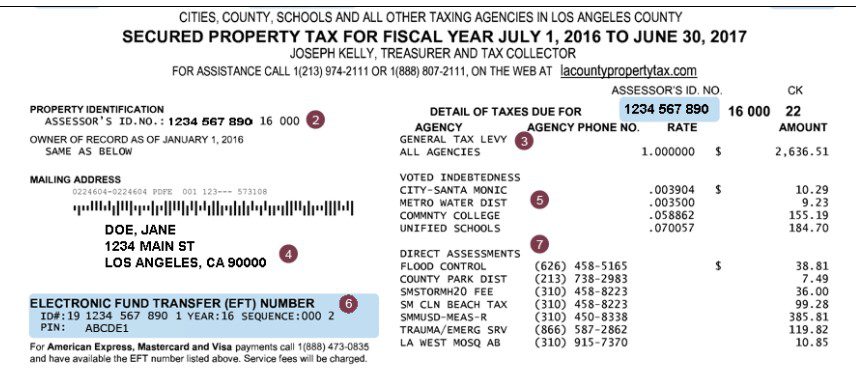

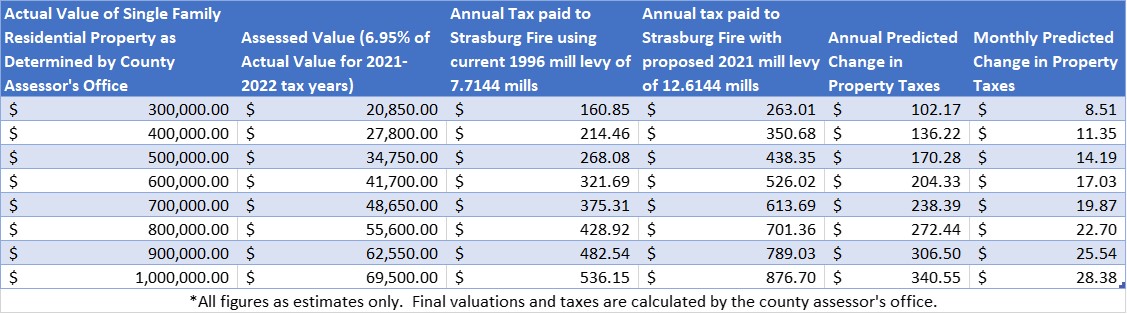

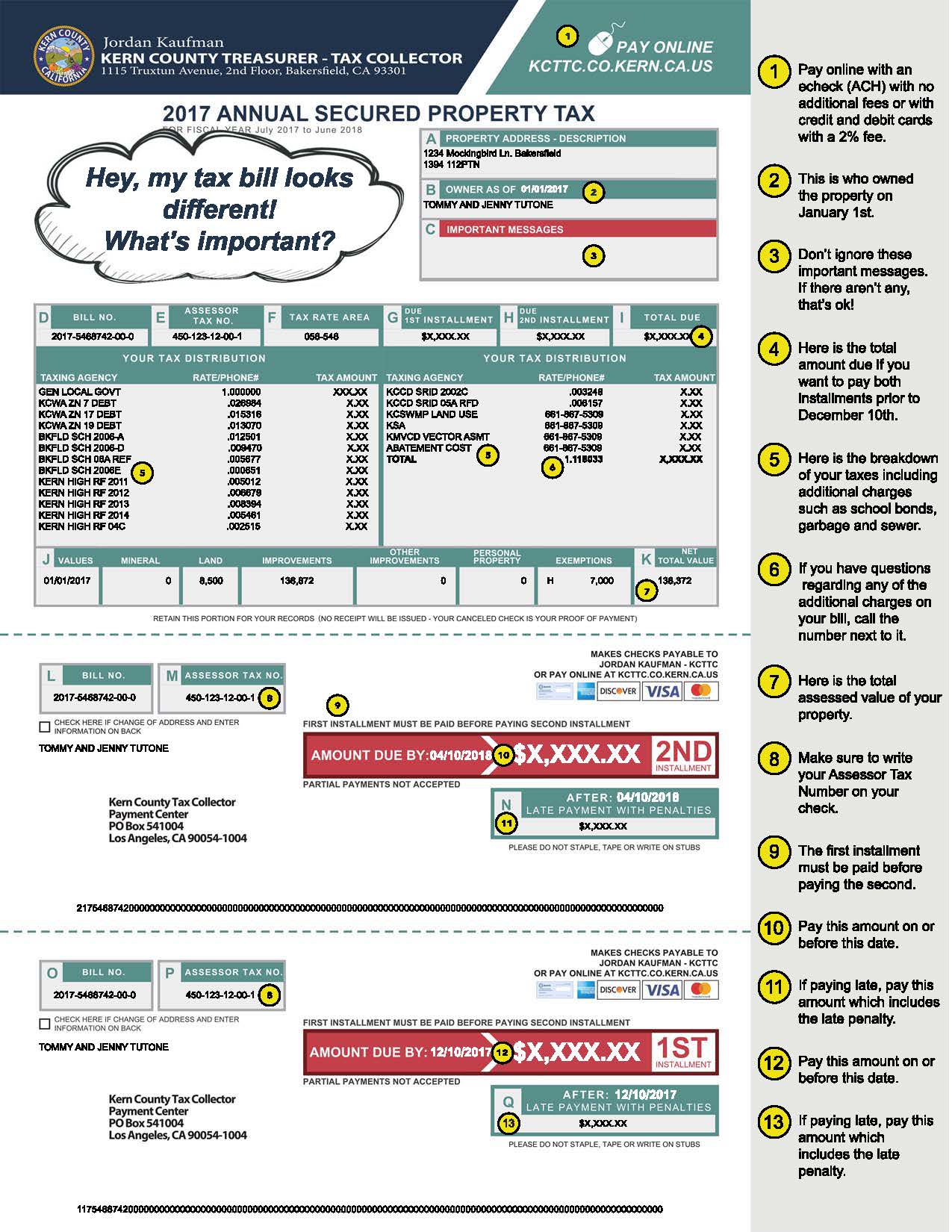

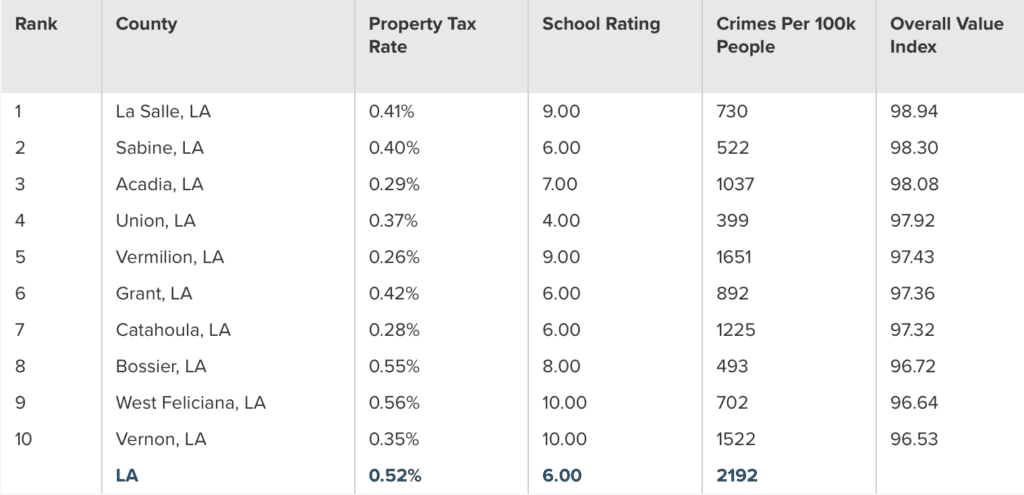

Web Result To calculate the taxes on your property you must take the Assessed Value which is a percentage of Fair Market Value and multiply it by the appropriate tax or. Web Result The statewide average property tax rate is 051. Web Result Taxes are calculated by multiplying the assessed value by the tax rate set by various millages bond millage rates and parcel fees voted on by registered voters in.

Web Result Calculate how much youll pay in property taxes on your home given your location and assessed home value. 038 of home value. After-Tax Income Total Income Tax.

Web Result 1Fair Market Value. This is an estimate of what your property would. Web Result To calculate your property taxes start by typing the county and state where the property is located and then enter the home value.

Web Result Our Bossier Parish Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden. Web Result Estimate My Jefferson Parish Property Tax. Web Result Property Tax Calculator.

Web Result While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor you can use the free Louisiana Property Tax. Yearly median tax in Lafayette Parish. Web Result Louisiana State Tax Quick Facts.

Use this New Orleans property tax calculator to estimate your annual property tax payment. Web Result With an annual wage of 50000 in 2023 a single filer will take home 4067075with a total income tax of 932925. Web Result Estimate My Louisiana Property Tax.

Our Jefferson Parish Property Tax Calculator can estimate your property taxes based on similar properties and. Web Result 4815 - 5670. Updated on Feb 16 2024.

Web Result The Louisiana Tax Calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in Louisiana the calculator allows you to. Louisiana uses the fair market value approach to calculate your property tax. With these two numbers you.

1

Fintel

Scvnews Com

1

Fintel

Wttw News

El Paso County Treasurer El Paso County Colorado

Strasburg Fire Protection District

Www Kcttc Co Kern Ca Us

Vernon Parish Assessor

Southern Title

Smartasset

Acadia Parish Chamber Of Commerce

Smartasset

Itep Org

Pdffiller

Issuu